British Prime Minister Keir Starmer signed the landmark $\textsterling 8$ billion deal for 20 Eurofighters in Ankara on October 27, 2025, bolstering NATO’s flank but raising serious human rights concerns.1

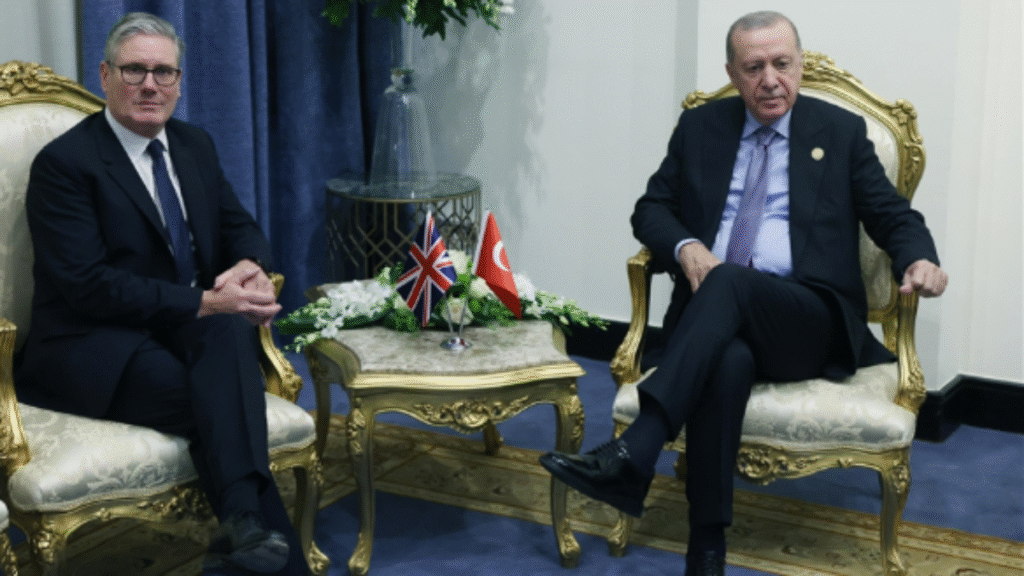

In a crucial move reshaping regional air power, the United Kingdom and Turkey finalized an $\textsterling 8$ billion agreement on October 27, 2025, for the sale of 20 Eurofighter Typhoon jets, securing thousands of British jobs while providing Ankara with a vital stopgap capability to reinforce its commitments to NATO.1 The deal, sealed during Prime Minister Keir Starmer’s first official visit to meet Turkish President Recep Tayyip Erdoğan in Ankara, marks the UK’s largest fighter jet export in a generation.

The Landmark Agreement: What Turkey Purchased and for How Much

The agreement, formally signed by the two leaders, commits Turkey to acquiring 20 new Eurofighter Typhoons in a comprehensive deal valued at approximately $\textsterling 8$ billion.1 This total financial figure, which equates to roughly $\$ 10.7$ billion, includes not only the advanced airframes but also essential maintenance packages, pilot training, and weapons integration required for operational readiness.3 Although some initial reports referenced a $\textsterling 5.4$ billion price tag, the $\textsterling 8$ billion figure represents the full scope of the commitment.6

This significant defense procurement represents the first new order for UK-built Typhoon fighters since 2017.2 The aircraft assembly will primarily be conducted by BAE Systems in the United Kingdom, specifically at the Warton facility in Lancashire, with final delivery of the new jets scheduled to begin in 2030.1

The massive scale of this transaction, officially described by London as a “landmark agreement” and the “biggest fighter jet deal in a generation,” underscores the deal’s strategic importance to the UK defense industrial base.1 The urgency of the UK government to secure this contract was driven by economic necessity, providing Turkey with significant leverage during the negotiation process. The context surrounding the Eurofighter Turkey deal makes it clear this acquisition is a pivotal moment for the defense industries of both nations and the strategic balance of NATO.

Geopolitical Strategy and the Airpower Gap

Turkey’s commitment to the Eurofighter program stems from a profound and immediate requirement to modernize its air force capabilities amid escalating regional tensions. The Turkish Air Force (TurAF) operates an aging fleet largely consisting of US-made F-16s and F-4s.5 While Turkey is developing its indigenous fifth-generation fighter, the KAAN, that jet is not projected to enter significant service until 2028 or later.2 The Typhoon is, therefore, viewed by Ankara as a necessary “stopgap solution” to bridge the capability deficit until the KAAN project matures.8

The Ghost of the F-35: S-400 Sanctions and US Relations

The pursuit of the Eurofighter Typhoon is a direct result of Turkey’s complicated defense relationship with the United States. Ankara was formally expelled from the U.S.-led F-35 Joint Strike Fighter program in 2019 following its acquisition and deployment of the Russian S-400 missile defense system.9 This removal created a critical void in Turkey’s air force modernization plans, as Ankara had initially planned to induct over 100 F-35A jets.

Despite efforts by Turkish officials to suggest that the friction surrounding the S-400 system had been resolved, Washington maintains its definitive position. A senior US State Department official reaffirmed in August 2025 that the Russian system is still considered incompatible with NATO defense systems and US law, precluding Turkey’s re-entry into the F-35 program.

For the US audience, this enduring tension defines the limits of defense cooperation. The Eurofighter Turkey deal serves as a strategic European security hedge against persistent US sanctions and political conditions. By choosing a robust, NATO-standard European platform, Turkey ensures that its air power maintains interoperability with the alliance, mitigating the security risk imposed by the US political decision while simultaneously asserting its strategic autonomy. The decision signals that if the US remains constrained by sanctions, European partners are prepared to step in to meet NATO’s military needs.

Overcoming the German Hurdle: A Diplomatic Shift in Mid-2025

The Eurofighter Typhoon is manufactured by a consortium managed by the NATO Eurofighter and Tornado Management Agency (NETMA), representing the UK, Germany, Italy, and Spain.11 Any major export sale, particularly one of this magnitude, requires approval from all four partners.

Germany initially posed the most significant political hurdle, utilizing its veto power to block the sale to Turkey.2 This opposition was reportedly tied to long-standing political concerns, including Turkey’s stance on geopolitical conflicts and regional issues, such as the Gaza war.12

The provisional agreement for the jets could only move forward in July 2025 after Germany lifted its opposition, clearing the way for the deal.2 The eventual removal of the German veto followed intense diplomatic lobbying led by the UK and highlights the profound balancing act within NATO. The necessity of reinforcing the alliance’s second-largest military, coupled with the critical economic imperative of preserving the European defense production line, ultimately outweighed the members’ political disagreements with Ankara’s foreign policy stances.6

Technical Capability and Accelerated Delivery

Integrating the Typhoon into the Turkish Air Force represents a major doctrinal shift, requiring Turkish pilots—who traditionally fly US-made jets—to adapt to the European twin-engine, canard delta wing design.8 The aircraft procured are expected to be the modern Tranche 4 variant, featuring upgraded avionics and the highly capable Captor-E Active Electronically Scanned Array (AESA) radar.8

Air Superiority vs. Stealth: The Typhoon in the Modern Conflict

The Typhoon maintains a strong reputation for excelling in close-quarters combat and air superiority roles, prioritizing high-speed agility (Mach 2.0 or 1,550 mph) and mission versatility.14 This contrasts with the F-35’s design emphasis on stealth, deep sensor integration, and network-centric capabilities, which caps its maximum speed at Mach 1.6 (1,200 mph).14

For Turkey, which faces potential air threats in the Aegean and Eastern Mediterranean, the Typhoon’s raw performance provides an immediate, powerful deterrent capability that can effectively counter modern non-stealth adversaries.9 Additionally, the Typhoon boasts a greater internal fuel range (2,900 km) than the F-35 (1,931 km), offering enhanced operational reach across NATO’s strategically important eastern flank.14

The Accelerated Acquisition Strategy: Used Jets from Qatar and Oman

While the new aircraft procured through the UK are not expected to be delivered until 2030, Turkey’s operational urgency necessitates an immediate solution. To bridge this critical five-year timeline, Turkey is pursuing an aggressive secondary strategy involving the acquisition of used, operational Typhoons from its Gulf partners.4

Turkish Defence Minister Yaşar Güler confirmed that Turkey plans to acquire 12 second-hand jets from Oman, in addition to advanced discussions regarding the redirection of a pending order from Qatar.5 Turkey is reportedly in advanced talks with Doha to redirect Qatar’s additional order of 12 upgraded Tranche 4 Eurofighters directly to the Turkish Air Force.9

This sub-transfer arrangement, if finalized, would allow Turkey to receive operational jets as early as 2026, providing crucial time for pilot training and infrastructure familiarization years ahead of the new-build aircraft’s arrival.9 The combination of new, highly customized jets delivered in 2030, and multiple batches of used aircraft potentially arriving as early as 2026, creates an immediate logistical challenge regarding configuration and maintenance. However, this pragmatic logistical compromise underscores the deep military necessity driving Turkey’s response to its air defense crisis. The accelerated capability provided by the Qatari redirection significantly maximizes the immediate strategic value of the overall Eurofighter Turkey deal.9

Economic Stakes and Transatlantic Implications

The UK government championed the defense sale as a massive success for British industry and workers. Prime Minister Starmer called the agreement “a win for British workers, a win for our defence industry”. The deal is projected to secure an estimated 20,000 British jobs across the extensive Typhoon supply chain, including BAE Systems assembly sites in Warton and component facilities in Samlesbury, Edinburgh, and Bristol.

Industrial Salvation for the UK

The contract serves as industrial salvation for BAE Systems. Earlier in 2025, trade unions had warned that without new export orders, the Warton production line faced the risk of closure, jeopardizing skilled aerospace jobs.6 The Turkish order successfully provides the necessary continuity, ensuring the UK’s Typhoon production capability remains intact until at least the 2030s.2

The reliance on this massive export order to maintain the domestic defense industrial base illustrates how significant economic factors shaped the UK’s diplomatic approach toward Ankara. This financial necessity provided the crucial impetus for the UK to aggressively pursue the deal and overcome the political resistance within the Eurofighter consortium.

Bolstering Alliance Strength

The strategic benefit for NATO is tangible. Turkey is a pivotal ally, possessing the second-largest military in the alliance, and its geographical position as the “gatekeeper to the Black Sea” is critical to regional deterrence. Equipping Turkey with a modern, NATO-standard fighter jet enhances the alliance’s collective strength in the volatile Eastern Mediterranean and Black Sea regions.

From Washington’s perspective, while the US remains locked in political friction with Ankara over the S-400, the Eurofighter Turkey deal ensures that a core NATO ally maintains robust, interoperable air capabilities. Even without the F-35, the Typhoon guarantees that Turkish air power remains compatible with alliance protocols, thereby mitigating the security consequences of the diplomatic deadlock between Ankara and Washington.

Controversy and the Human Cost

The signing of the deal was not without significant controversy, attracting criticism over the UK’s apparent willingness to prioritize economic gain and security cooperation over human rights concerns in Turkey.

The Political Price: Human Rights Concerns Shadow the Deal

The UK agreed to finalize the sale despite concerns regarding alleged human rights violations by the Turkish government, a decision that critics argue involved “overlooking concerns about some of its buyers’ human rights records”.1

Amnesty International UK, among others, publicly criticized the move, calling on Prime Minister Starmer to address the “disturbing state of human rights in Türkiye” and ensure the deal did not “provide diplomatic cover” for abuses.

Crisis of Governance: Charges Against a Key Rival

The political controversy was intensified by the timing of the signing ceremony. The deal was finalized on October 27, 2025, precisely as Turkish prosecutors filed fresh charges against President Erdoğan’s chief political opponent, Ekrem İmamoğlu.1 İmamoğlu, the jailed former Mayor of Istanbul, who was already imprisoned on corruption charges since March, now faces serious allegations, including alleged links to British intelligence and espionage.

Critics of the Turkish government condemned these new charges as a “blatant attempt” to keep the opposition leader out of future political competition.1 Although a spokesperson for the UK Prime Minister stated that London had raised concerns over the arrests and expected Turkey to “uphold its international obligations and the rule of law,” the British delegation proceeded with the high-profile signing, offering Ankara a moment of significant international validation.1

The Human Impact: A Diplomatic Shield

The high-profile signing ceremony, involving the Prime Minister of a major European NATO power, provided President Erdoğan’s administration with a crucial diplomatic endorsement at a time when he was facing intense international scrutiny over his government’s crackdown on opposition figures.1 This trade-off—a massive security and industrial victory exchanged for diplomatic silence on democratic concerns—forces NATO allies, particularly the US, to continually reconcile pressing military security needs with the promotion of democratic values in their relationship with Ankara.16 This political calculation highlights the significant cost of maintaining alliance cohesion when faced with democratic backsliding in a strategically vital partner nation.

Forward Outlook and Implications

What’s Next: Delivery, Industrial Cooperation, and Future Orders

With the agreement secured, BAE Systems and the Eurofighter consortium are focused on managing the long production schedule leading to the 2030 delivery timeline.1 Meanwhile, Turkey will aggressively pursue the accelerated acquisition strategy for the used jets from Qatar and Oman, aiming to achieve initial operational capability (IOC) years sooner.9

The existing agreement for 20 new aircraft also provides an option for future sales, potentially allowing Turkey to reach its initial goal of acquiring 40 Typhoons.2 The activation of these options will depend on Turkey’s continued defense spending priorities and the ongoing political consensus among the Eurofighter consortium partners.

Long-Term Interplay: KAAN and European Dependency

The Eurofighter acquisition is explicitly designed to serve as a bridge until the KAAN fifth-generation fighter becomes fully operational after 2028.5 Should the domestic KAAN project encounter technical or financial delays, the option for additional Eurofighters provides Ankara with a crucial alternative strategy, ensuring the continuity of its air superiority goals.

This landmark Eurofighter Turkey deal solidifies an emerging defense axis between Turkey and European NATO powers (the UK, Italy, and Spain) that operates strategically outside the direct political constraints of Washington, D.C. This European pivot allows Ankara to maintain NATO-level military strength and interoperability while still retaining the controversial Russian S-400 system. The arrangement demonstrates a strategic diffusion of power within the alliance, positioning European defense firms as preferred partners when political constraints limit US engagement with strategically important NATO allies.