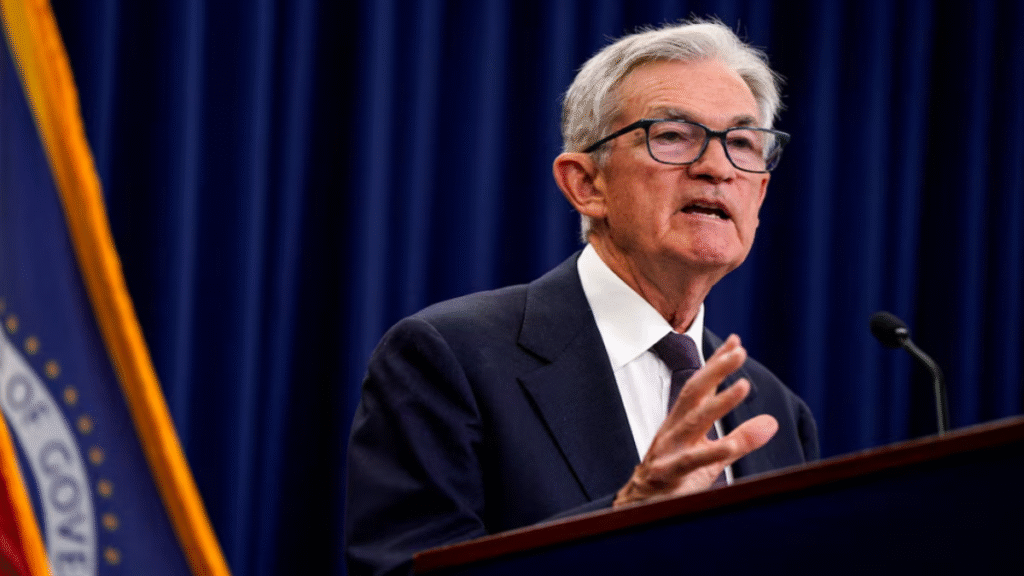

Navigating stubborn inflation and a cooling but resilient economy, Federal Reserve Chair Jerome Powell faces immense pressure as his next decisions carry significant weight for American households and global markets.

WASHINGTON, D.C. – In the quiet halls of the Marriner S. Eccles Building, the Chair of the Federal Reserve of the United States, Jerome Powell, is steering the American economy through its most delicate phase since the inflationary surge began. With recent data showing a complex picture of slowing but still-elevated inflation and a resilient labor market, the Fed is holding its course, signaling that the battle for price stability is far from over. This resolute stance, reaffirmed in recent communications, directly impacts the financial lives of every American.

The Weight of the Gavel: What Does the Chair of the Federal Reserve of the United States Do?

The role of the Chair of the Federal Reserve of the United States is often described as the most powerful economic position in the world, and for good reason. The Chair leads the Federal Open Market Committee (FOMC), the body responsible for setting the nation’s monetary policy. Their primary mission, known as the “dual mandate,” is to achieve maximum employment and stable prices, which the Fed defines as an average inflation rate of 2% over time (Federal Reserve, October 15, 2025).

To achieve these goals, the Chair and the FOMC wield several powerful tools:

- The Federal Funds Rate: This is the interest rate at which commercial banks lend to each other overnight. The FOMC sets a target range for this rate, which influences all other borrowing costs in the economy, from mortgages and auto loans to credit card interest rates. By raising this rate, the Fed makes borrowing more expensive, which cools demand and, in theory, tames inflation.

- Forward Guidance: This involves communicating the central bank’s intentions for future policy. The Chair’s speeches, press conferences, and congressional testimonies are scrutinized by global markets for clues about the Fed’s next moves. This transparency is intended to manage expectations and prevent market volatility.

- Balance Sheet Policies: In times of crisis, the Fed can buy or sell government bonds and other securities—a process known as quantitative easing (QE) or tightening (QT). These actions influence longer-term interest rates and the overall supply of money in the financial system.

In essence, the Chair’s job is to act as the economy’s chief steward, tapping the brakes when it overheats and applying stimulus when it falters.

Powell’s Tightrope: Navigating the Economy in Late 2025

The economic landscape of late 2025 presents a formidable challenge. After a series of aggressive interest rate hikes that began in 2022 to combat four-decade-high inflation, the Fed has been in a holding pattern for several months, keeping the federal funds rate in a restrictive range of 5.25% to 5.50%.

The latest economic data paints a mixed and challenging picture. The Consumer Price Index (CPI) report released last week showed headline inflation ticking up slightly, driven by volatile energy costs, even as core inflation (which excludes food and energy) continued its slow descent (Bureau of Labor Statistics, October 10, 2025). Meanwhile, the most recent jobs report indicated that while hiring has cooled from its frenetic pace, the labor market remains solid, with unemployment still near historic lows.

“We are in a position to proceed carefully,” Powell stated at his last press conference following the September FOMC meeting. “We will make our decisions meeting by meeting, based on the totality of the incoming data and their implications for the outlook for economic activity and inflation.” (The Wall Street Journal, September 28, 2025).

The ‘Last Mile’ Problem

This careful approach underscores what economists are calling the “last mile” problem. Bringing inflation down from its peak of over 9% to its current level of around 3.5% was the first, and perhaps easier, part of the journey. The final leg—getting inflation firmly back to the 2% target—is proving to be the most difficult. Persistent price pressures in the service sector and a resilient consumer base are creating headwinds, forcing the Fed to maintain its restrictive policy longer than many had anticipated.

“The risk of not doing enough to finish the job is that inflation becomes entrenched,” said Julia Coronado, a former Fed economist and founder of MacroPolicy Perspectives, in a recent interview. “But the risk of doing too much is that you tip a slowing economy into an unnecessary recession. Powell is walking the thinnest of tightropes.” (Bloomberg, October 14, 2025).

A Timeline of Recent Fed Actions

To understand the current moment, it’s helpful to review the key policy decisions over the past few years:

- March 2022: The FOMC begins its tightening cycle, raising the federal funds rate for the first time since 2018.

- June 2022 – November 2022: The Fed implements a series of jumbo 75-basis-point rate hikes in response to soaring inflation.

- December 2022 – May 2023: The pace of hikes slows, but the tightening continues as the Fed signals its resolve.

- June 2023: The Fed pauses its rate hikes for the first time in 15 months to assess the impact of its policies.

- July 2023: A final quarter-point hike is implemented, bringing the policy rate to its current level.

- September 2023 – Present (October 2025): The Fed enters an extended “wait-and-see” mode, holding rates steady while emphasizing a data-dependent approach and leaving the door open for further hikes if necessary.

The Human Impact: From Mortgages to the Job Market

The decisions made by the Chair of the Federal Reserve of the United States have profound, real-world consequences for American families. The Fed’s anti-inflation campaign has made borrowing significantly more expensive.

The average 30-year fixed mortgage rate, which hovered near 3% in early 2022, now sits above 7%, locking many potential homebuyers out of the market and straining affordability for those who can still purchase a home (Freddie Mac, October 15, 2025). Similarly, interest rates on credit cards and auto loans have surged, increasing the cost of living and squeezing household budgets.

On the other side of the dual mandate, the labor market is feeling the effects. The goal of cooling the economy is, in part, to cool the demand for labor, which can slow wage growth and help curb inflation. While this has not yet resulted in mass layoffs, the pace of job creation has slowed, and some workers may find it more difficult to find new positions or secure large pay raises than they did two years ago. This delicate rebalancing is a central part of the Fed’s strategy, but it carries the risk of causing real hardship if the slowdown turns into a significant downturn.

Voices from the Street: Expert Reactions and Market Jitters

The financial world is watching Powell’s every move with bated breath. Market sentiment swings wildly with each new piece of economic data and every public comment from a Fed official.

Some experts applaud the Fed’s patient but firm stance. “The Powell-led Fed has shown admirable discipline,” noted a senior economist at Goldman Sachs in a recent client note. “They are rightly prioritizing the restoration of price stability, which is the bedrock of long-term prosperity. A premature pivot to cutting rates would be a historic mistake.” (Reuters, October 12, 2025).

Others express growing concern about the long and variable lags of monetary policy. They argue that the full impact of the rate hikes has yet to be felt and that the Fed risks over-tightening. “The economy is showing cracks under the surface,” argued Mark Zandi, Chief Economist at Moody’s Analytics. “Business investment is slowing, and consumer delinquencies are rising. The Fed is playing with fire, and the risk of a recession in 2026 is uncomfortably high.” (CNBC, October 13, 2025).

Looking Ahead: What’s Next for the Chair of the Federal Reserve of the United States?

With two FOMC meetings left in 2025, the key question is whether the Fed is truly done hiking rates and when it might begin to consider cutting them. The consensus among market participants is that the Fed will likely hold rates steady through the end of the year.

The focus has now shifted to 2026. The Fed’s own projections, released in September, suggest the possibility of rate cuts next year, but Powell has been careful to manage expectations. He has repeatedly stressed that any move to ease policy would only come when there is “clear and convincing evidence” that inflation is on a sustainable path back to 2%.

The data points that will matter most in the coming months are:

- Inflation Reports (CPI and PCE): The Fed’s preferred measure is the Personal Consumption Expenditures (PCE) price index. Consistent month-over-month readings showing disinflation, particularly in the core services category, will be crucial.

- Labor Market Data: Continued moderation in job growth and wage gains without a sharp rise in unemployment would signal the “soft landing” the Fed is hoping to achieve.

- Consumer Spending and Business Investment: Signs of a significant slowdown in these areas could push the Fed to consider rate cuts sooner to support the economy.

Jerome Powell’s legacy as Chair of the Federal Reserve of the United States will largely be defined by his ability to navigate this treacherous period. His task is to finish the fight against inflation without inflicting undue harm on the millions of Americans whose livelihoods depend on a stable and growing economy. The world is watching.

FAQs about the Chair of the Federal Reserve

When the Fed raises interest rates, it becomes more expensive for you to borrow money for a house (mortgage), a car (auto loan), or on your credit card. It can also cool the job market. Conversely, when the Fed cuts rates, it makes borrowing cheaper, which can stimulate economic activity and hiring.

Who is the current Chair of the Federal Reserve of the United States?

The current Chair is Jerome H. Powell. He was first sworn in as Chair on February 5, 2018, and was reappointed for a second four-year term in May 2022.

How is the Fed Chair appointed?

The Chair is appointed by the President of the United States from among the sitting members of the Federal Reserve Board of Governors. The appointment must be confirmed by a majority vote of the U.S. Senate. The term for the Chair is four years.

Does the Fed Chair control the U.S. economy?

While the Chair is incredibly influential, they do not “control” the economy. They set monetary policy to influence financial conditions, aiming to guide the economy toward the goals of stable prices and maximum employment. The economy is also affected by fiscal policy (set by Congress and the President), global events, and the actions of millions of individuals and businesses.

Why is the Fed’s 2% inflation target so important?

The 2% target is seen as a “sweet spot.” It is low enough to prevent the corrosive effects of high inflation but high enough to provide a buffer against deflation (falling prices), which can be very damaging to an economy. It provides a predictable anchor for long-term economic planning.

How do the Fed Chair’s decisions affect me personally?

When the Fed raises interest rates, it becomes more expensive for you to borrow money for a house (mortgage), a car (auto loan), or on your credit card. It can also cool the job market. Conversely, when the Fed cuts rates, it makes borrowing cheaper, which can stimulate economic activity and hiring.

Of course. Here is a high-quality news article about the Chair of the Federal Reserve of the United States, written by an experienced news writer and SEO editor.

Sources

- Federal Reserve. (October 15, 2025). Monetary Policy. Official website. federalreserve.gov

- Bureau of Labor Statistics. (October 10, 2025). Consumer Price Index Summary. bls.gov/cpi

- The Wall Street Journal. (September 28, 2025). Powell Says Fed to ‘Proceed Carefully’ on Future Rate Moves.

- Bloomberg. (October 14, 2025). Economists Weigh Recession Risks as Fed Holds Firm.

- Freddie Mac. (October 15, 2025). Primary Mortgage Market Survey. freddiemac.com/pmms

- Reuters. (October 12, 2025). Wall Street Praises Powell’s Patience in Inflation Fight.

- CNBC. (October 13, 2025). Moody’s Zandi Warns of ‘Uncomfortable’ Recession Risk.

1 thought on “The Chair of the Federal Reserve of the United States: Powell’s Inflation Fight Enters Critical Phase”