IRS Announces 2025 Tax Bracket Adjustments and New Tax Law Changes

The IRS has raised 2025 tax-bracket thresholds to offset inflation, while the new “One Big Beautiful Bill Act” makes the 2017 tax cuts permanent. This means Americans will generally enjoy higher thresholds for federal tax rates in 2025.

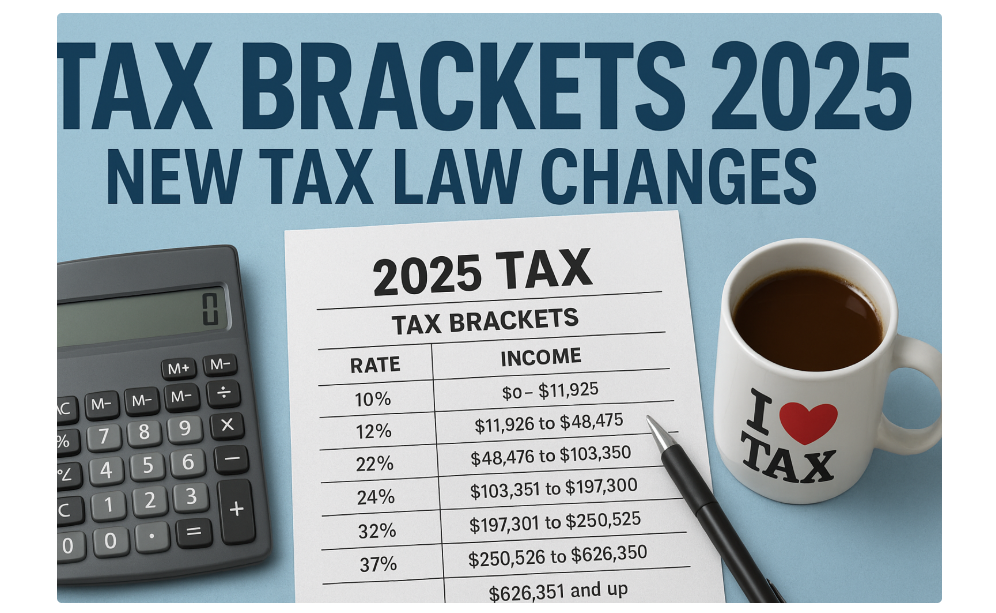

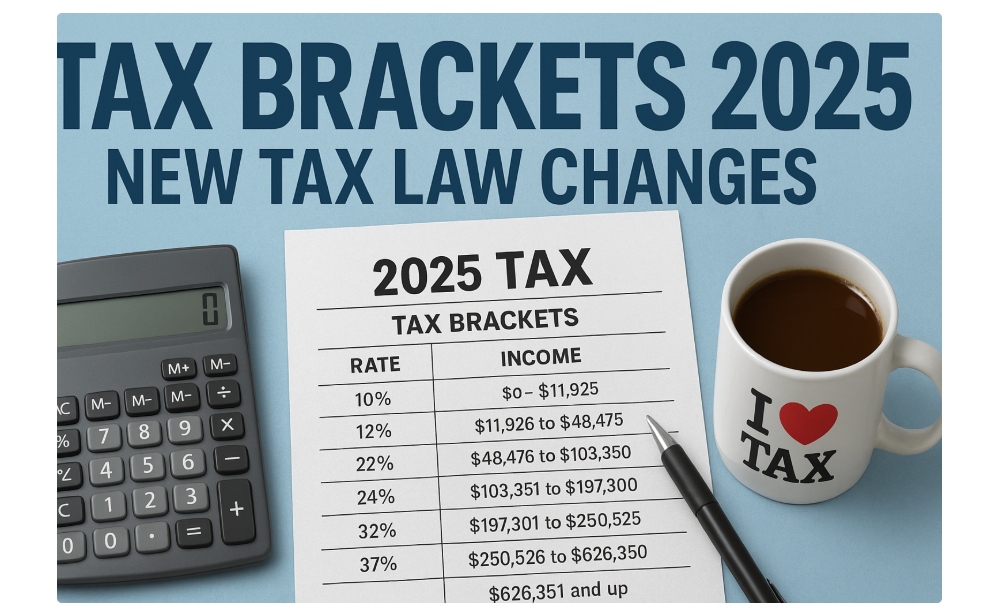

On October 22, 2024, the IRS released its annual inflation adjustments for the tax year 2025 (returns filed in 2026). The seven federal income tax rates remain the same, but the income levels for each bracket were raised. For example, in 2025, the top 37% rate kicks in at $626,351 for single filers (up from $609,351 in 2024), and $751,601 for married couples filing jointly. Other bracket thresholds (10%, 12%, 22%, 24%, 32%, 35%) also saw roughly 2–3% increases on average. In practical terms, taxpayers will have to earn more income in 2025 before they enter a higher tax rate—helping to prevent “bracket creep,” a phenomenon where inflation pushes people into higher brackets without real income gains.

IRS Adjusts 2025 Tax Brackets for Inflation

Each year the IRS adjusts tax parameters based on inflation data (using the Consumer Price Index). These automatic increases are aimed at preventing bracket creep, ensuring that moderate wage gains do not push people into higher tax rates without a real rise in living standards. For 2025, the IRS applied a ~2.8% average increase to bracket thresholds. The standard deduction also rose: single filers can deduct $15,750 (up $750) and joint filers $31,500 (up $1,500) in 2025. These inflation adjustments will slightly boost take-home pay by keeping more income in lower brackets, as the IRS noted, it is an annual “reset” to provide relief.

The new bracket thresholds for 2025 are as follows:

- 10% on income up to $11,925 (single) or $23,850 (married)

- 12% up to $48,475 (single) / $96,950 (married)

- 22% up to $103,350 (single) / $206,700 (married)

- 24% up to $197,300 (single) / $394,600 (married)

- 32% up to $250,525 (single) / $501,050 (married)

- 35% up to $626,350 (single) / $751,600 (married)

- 37% above $626,350 (single) / $751,600 (married).

These were announced by the IRS in October 2024 (Revenue Procedure 2024-40).

In plain terms, a single person making $50,000 in 2025 will remain in the 12% bracket (instead of potentially moving to 22%) because the 12% bracket now extends further up. Likewise, middle-class families’ incomes will be more lightly taxed. As Investopedia explains, annual inflation indexing “prevents bracket creep,” so taxpayers don’t see higher taxes just from inflation. In fact, every year since 2019, the IRS has explicitly noted these inflation offsets in its releases.

One Big Beautiful Bill Act Makes 2017 Tax Cuts Permanent

In addition to automatic inflation updates, Congress enacted a major tax law in mid-2025. On July 4, 2025, President Trump signed the One Big Beautiful Bill Act (Public Law 119-21) into law. This reconciliation bill cemented the 2017 Tax Cuts and Jobs Act (TCJA) provisions that were originally set to expire after 2025. In practice, that means the seven bracket rates (10–37%) are now permanent, and some thresholds and deductions were slightly expanded.

Under the new law, key TCJA features – such as the larger standard deduction and no personal exemptions – remain in place. The bill also included special deductions for 2025, like write-offs for tips and overtime, and even car loan interest. But from the bracket perspective, the main effect is that 2025 taxes (filed April 2026) will still use the TCJA’s seven-rate schedule, and those rates won’t revert in 2026 as they otherwise might have. As BakerHostetler analysts note, the legislation ensures 2017’s lower rate structure carries forward (with only minor 2026 inflation tweaks to the two lowest rates).

For 2025 specifically, the new law slightly increased some thresholds and deductions. Notably, it boosted the standard deduction above what the IRS had initially set: instead of $15,000 (single) and $30,000 (joint), the law raised them to $15,750 and $31,500, respectively. (Fox Business confirms these new amounts in its Oct. 2025 reporting) The tax rates themselves (10%, 12%, … 37%) remain exactly as announced by the IRS. In short, most Americans will pay under the same tax schedule they’ve known – it’s just indexed for inflation and now permanent.

How Changes Affect Taxpayers

For most Americans, these updates mean modestly lower taxes in 2025 compared to not adjusting at all. Indexing brackets to inflation prevents stealth tax hikes. According to CBS MoneyWatch, the bracket reset means Americans have to earn more to hit a new rate, which in turn can increase take-home pay. For example, in 2025, a $50,000 single filer stays in the 12% bracket; without adjustment,s they might have been bumped into 22% with just a small raise.

The extended tax cuts also have distributional effects. Some analysis (and Republican lawmakers) point out that middle- and low-income workers – who saw no bracket changes – indirectly benefit by keeping their lower marginal rates permanent. High earners, meanwhile, remain under the same 37% top rate, which is locked in by the new law. Overall, the Congressional Joint Committee on Taxation estimated that 66% of the tax cuts from the “Big Beautiful Bill” go to families earning under $50,000, largely due to preserving the standard deduction and child tax credit increases.

On the ground, tax filers likely won’t see dramatic shocks. Payroll withholding and estimated payments will adjust based on the new brackets and deductions. As U.S. Bank explains, these changes “will slightly boost paychecks for many Americans” who keep more earnings from being taxed at higher rates. For families and seniors, certain provisions like the higher child tax credit (up to $2,200 per child) and extra deductions for older taxpayers were also part of the 2025 law changes.

*Fig: Tax preparer calculating with 2025 tax documents open on a laptop. The updated brackets and deductions mean more income is taxed at lower rates, easing the tax burden for many. *

Alt text: Person using calculator and laptop on desk with 2025 tax forms showing updated tax brackets 2025.

Timeline of 2025 Tax-Bracket Changes

- Oct 22, 2024: IRS issues Revenue Procedure 2024-40 setting inflation-adjusted tax brackets and deductions for 2025. (Examples: 37% bracket starts at $626,351 single.)

- July 4, 2025: President signs the One Big Beautiful Bill Act (OBBBA), making 2017 TCJA tax brackets permanent and enacting targeted 2025 tax changes.

- Oct 2025: IRS announces inflation adjustments for tax year 2026 (which include slight further updates), confirming the permanent nature of TCJA rates.

- Apr 15, 2026: Tax Day – Americans will file 2025 returns using the new brackets and deductions.

What’s Next: Watch for 2026 and Beyond

Looking ahead, taxpayers can now be certain the seven-rate system (10–37%) will continue beyond 2025, barring future legislation. The IRS will again index brackets to inflation for 2026 returns, but the base structure is locked. Analysts will watch whether Congress makes any further tax policy changes or starts adjusting rates in 2027.

Meanwhile, many Americans should review payroll withholding and estimated taxes to account for the higher brackets and deductions. Tax professionals recommend clients use updated IRS tables to avoid under-withholding and consider any new deductions (like the tip/overtime provisions) for 2025.

The overall implications: incremental relief for taxpayers in 2025, and long-term stability in tax rates. As one expert put it, by indexing for inflation and making cuts permanent, lawmakers have ensured that “taxpayers should not pay more just because of inflation”.

“The IRS’s annual inflation adjustments for 2025 help protect Americans from paying higher taxes simply because prices went up,” notes tax analyst Julia Kagan of Investopedia. She explains that without these adjustments, “taxpayers would be forced to pay higher tax rates” on stagnant incomes. The Congressional Budget Office predicts that keeping TCJA rates permanent will cost the government billions, but supporters argue it provides long-term certainty for families. In a CBS News briefing, IRS Commissioner Danny Werfel emphasized that the agency’s role is to administer the law as written – meaning these new brackets and deductions go into effect when people file their 2025 returns next year